Hedge funds, social networks and risk

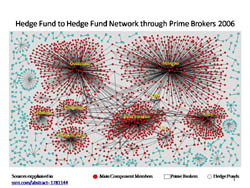

The research consortium has assessed idiosyncratic risk in the hedge fund industry by studying the individual attributes, social networks and perceptions of the leading actors involved. Researchers have also carried out literature reviews and conducted interviews with leading figures in the industry to increase their understanding of the sector. Interviews have been conducted with major investment banks and other institutions, involving brokers, hedge fund managers, investment analysts and regulators. Following a detailed literature review researchers now have a better appreciation of the relationship between networks, risk taking and performance. Benefits include greater access to resources and data but drawbacks can involve information overload that can affect the performance of those at the centre of the networks. Being at the centre of a network may make an actor more powerful and able to take risks. However, powerful actors may be reluctant to take risks because they have more to lose. Findings by the 'Social networks and idiosyncratic risk in the hedge funds industry' (SNIR) project will provide valuable insights for EU and national regulators who wish to further regulate the activities of hedge funds.